US President Donald Trump, seen in May 2025, slapped sweeping tariffs on most countries in April

Washington (AFP) - The US Federal Reserve’s preferred inflation measure cooled more than expected last month, according to government data published Friday, as President Donald Trump’s “liberation day” tariffs on most countries came into effect.

The personal consumption expenditures (PCE) price index rose 2.1 percent in the 12 months to April, down from a revised 2.3 percent a month earlier, the US Commerce Department said in a statement.

This was slightly below the median forecast of 2.2 percent from economists surveyed by Dow Jones Newswires and The Wall Street Journal, and leaves headline inflation just above the Fed’s long-term target of two percent.

Headline inflation rose 0.1 percent on a monthly basis, as did a widely watched inflation measure stripping out volatile food and energy costs.

So-called “core” inflation rose 2.5 percent from a year ago – also slightly below expectations of a 2.6 percent increase.

“We’re seeing evidence that we were on track for a perfect landing when it comes to inflation,” EY Chief Economist Gregory Daco told AFP.

“But that unfortunately came before the tariff storm that is likely to lead to an inflationary acceleration over the course of the summer.”

Much of the monthly increase came from a 0.5 percent rise in the indices for durable goods and energy, counterbalanced by a 0.3 percent fall in food prices, according to the Commerce Department.

Personal income increased by 0.8 percent last month on a seasonally adjusted basis, beating expectations.

And personal saving as a percentage of disposable personal income – a measure of how much consumers are saving – jumped to 4.9 percent in April from a revised 4.3 percent a month earlier.

“President Donald J. Trumps economic agenda is working,” White House Press Secretary Karoline Leavitt wrote on X.

“Inflation is down, income is up, and the trade deficit just fell by the largest amount on record,” she said, referring to the April advanced international trade deficit data, also published Friday, which fell 46 percent from a month earlier to $87.6 billion.

- Tariffs effect -

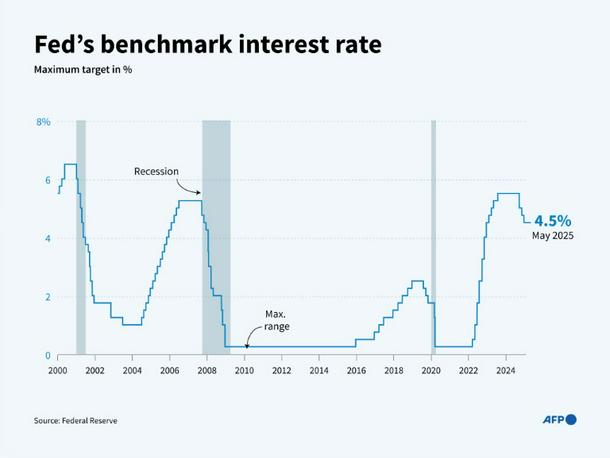

Infographic charting the changes in the benchmark interest rate of the United States Federal Reserve since 2000

Trump’s decision to roll out sweeping 10 percent levies on most countries on April 2, and significantly higher duties on dozens of trading partners days later – since paused – has been met by a flurry of legal action.

The court battles threaten to undermine his administration’s plans to use tariffs to raise revenue and punish partners running large trade deficits with the United States.

This week, the US Court of International Trade ruled that Trump had overstepped his authority, only for a federal judge to temporarily overrule their decision a day later to allow the tariff plans to continue, for now.

Daco from EY said while it was too soon for the tariffs to start having a meaningful impact on the data, there were signs that they were starting to push up prices, noting that the cost of furniture had risen after the “liberation day” duties came into effect.

“That bodes poorly for the inflation outlook over the coming months, as we’re likely to see more of the tariffs filter through to prices and in turn, weigh on consumer spending,” he said.

Daco’s views on the economic impact of tariffs chime with those of many economists, who expect the new levies to push up prices and slow growth – at least temporarily – a view disputed by the Trump administration.